Elevate Your Retirement: Essential Tips for Long-term Saving and Investing

Susan Kelly

Jan 31, 2024

Retirement can be a time of exciting new possibilities and well-earned rest from decades of hard work. But it can also become a terrifying prospect with visions of financial insecurity in the forefront of your mind. Over the course of our lives, many people have never saved enough for retirement due to unexpected expenses or limited income sources—but this doesn't mean your retirement journey needs to be one spent worrying about your finances. With some planning and diligence, you can save up enough money to not only retire comfortably but also improve upon pre-retirement financial successes. These essential tips will help guide you towards building long-term wealth that will set you up for years down the road and make sure you get the most out of every retirement day!

Create an achievable budget and stick to it:

Creating a budget and sticking to it is one of the best ways to ensure that you are saving enough money for retirement. Start by taking stock of your income, debts, and expenses, then create an achievable budget that allows you to save whatever you can each month. Be sure to include long-term savings goals in your budget as well, such as setting aside money for a retirement fund or investing in stocks and bonds.

Start saving as early as possible:

The earlier you start saving, the more time your money has to grow. The power of compounding interest can have an amazing effect on your savings if given enough time. Try to save at least 10-15% of your income each year as soon as you can and remember that even small contributions can add up over time. Make sure to check in regularly with your savings and adjust as needed, but don’t be afraid to give yourself a break from time to time.

Utilize retirement accounts:

Retirement accounts such as 401ks or IRAs are great tools for long-term saving and investing. Not only do they offer tax advantages, but you can also choose from a variety of investment options and have access to professional financial advice. Do your research and explore all the options available to you to make sure you select the best account for your needs.

Minimize debt:

Debt is one of the biggest obstacles that stands in the way of retirement security. Paying off debt can be a daunting process, but it is essential if you want to avoid being weighed down in retirement. Look for ways to reduce your interest rates and create a plan of attack that will help you get your debts under control before retirement rolls around.

Diversify investments:

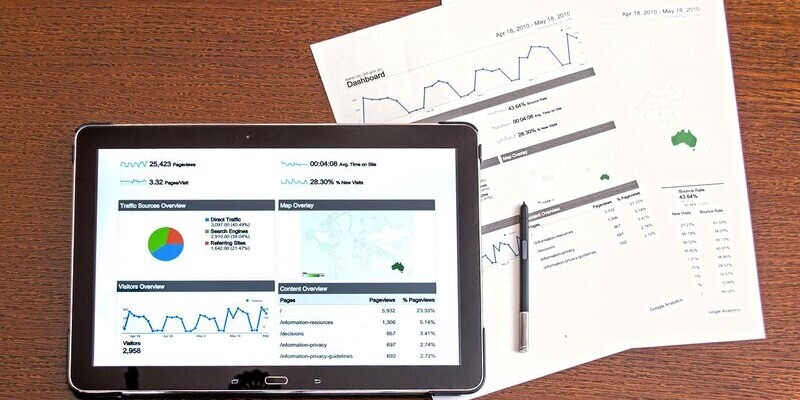

Diversifying your investment portfolio is key to long-term financial success. Don't put all your eggs in one basket - instead, spread out your investments across a variety of asset classes and industries. This will help you cushion any losses while still taking advantage of potential gains from other sectors. Consult with a professional investment advisor if necessary to make sure you are on the right track for retirement.

Keep learning:

Retirement planning is an ongoing process and it's important to keep up with changes in the market and financial advice. Make sure you regularly review your savings goals, investments, and overall retirement plan. Find reputable resources online or in books that will help you stay informed and make adjustments as needed. With some effort now, you can create a retirement plan that will set you up for success both now and in the future.

Stay active:

The key to a successful retirement is staying active and exploring new interests. Retirement doesn't have to mean putting life on hold - it can be an opportunity to try something new or pursue hobbies that have been pushed aside for years. Exercise, volunteering, travel, or even starting a business can all be great ways to stay engaged and make the most of your retirement years.

By following these tips, you can start on the path towards a secure and fulfilling retirement. With some planning and dedication now, you will be able to enjoy a comfortable lifestyle when it's time for your golden years. So take charge of your future today and don't forget to enjoy the journey!

Get a financial planner:

Finding an experienced, certified financial planner can be invaluable to help you meet your retirement goals. A professional can provide unbiased advice and valuable insight into your current investments and savings plans. They will be able to provide personalized strategies that will help you save more money while still enjoying life - now and in the years to come.

Take advantage of employer benefits:

Your employer may offer a variety of retirement benefits that can help you save for the future. Look into 401(k)s or other employer-sponsored plans to see if they might be suited for your retirement needs. Make sure to read all the fine print and do your research to make sure any plan you choose is the best fit for your own personal situation.

Conclusion:

Retirement planning can seem like a daunting task, but with some dedication and planning you can be ready to enjoy your golden years with financial security. Start by creating an achievable budget and sticking to it, saving as early as possible, utilizing retirement accounts, minimizing debt, diversifying investments, keeping learning about the market and financial advice, staying active in life, getting a financial planner, and taking advantage of employer benefits. With all these tips in mind, you will be ready to make the most out of your retirement years!

FAQs:

What is the best way to save for retirement?

The best way to save for retirement is to start early and take advantage of any employer-sponsored plans. Create an achievable budget that allows you to set aside money each month and look into various investment options such as stocks, bonds, or mutual funds. Utilize retirement accounts like 401ks or IRAs and get professional financial advice if necessary.

How much should I save for retirement?

The amount you should save for retirement will depend on your income, debts, and expenses as well as your long-term goals. As a general rule of thumb, try to set aside 10-15% of your annual income each year as soon as you can and adjust your savings goals as needed.