How Regularly Should You Review Your Checking Account?

Triston Martin

Oct 23, 2023

Keeping an eye on one's bank account has become routine as checking daily emails or the mailbox. The increasing popularity of online transactions and the convenience of debit card payments mean activity in your account can fluctuate significantly within a day. You remain informed about all financial activities by consistently overseeing your account and facilitating effective financial management.

Frequency of Monitoring Your Checking Account

There isn't a universally ideal frequency for account checks; however, the importance of consistent monitoring is undeniable. The multitude of weekly transactions, from debit card payments and automated bill settlements to ATM cash withdrawals, reinforces the need for vigilant oversight. Especially if you are searching for the best online checking account or exploring options for account check online and high interest checking accounts, keeping abreast of all financial moves is imperative.

For some, checking daily provides peace of mind, especially if their budget is tight or they expect certain payments to clear. Others may find a weekly check sufficient. A monthly review should be the minimum, allowing one to spot potential fraud unexpected fees, or evaluate spending patterns.

The Benefits of Consistently Checking Your Account

Monitoring your checking account regularly is similar to taking routine health check-ups. Just as these check-ups ensure our well-being, periodic checks of our accounts help maintain our financial health. Let's explore why regularly monitoring your checking account is so beneficial.

Spotting Unwanted Fees

When you keep an eye on your checking account, unexpected fees won't catch you off-guard. Whether it's a fee for monthly maintenance, using an ATM, or an incidental overdraft fee, regular checks ensure you spot them promptly. If you're often seeing these fees, consider alternatives. It's time to hunt for the best online checking account with minimal fees or none.

Why it matters: Those little fees can accumulate over time. Being vigilant allows you to save money and switch to a bank that respects your hard-earned cash.

Identifying Unauthorized Activity

The modern age, while convenient, brings challenges. One such challenge is the increased risk of scams. Keeping regular tabs on your account helps you swiftly notice suspicious activities. There could be a withdrawal you didn't authorize or a charge you don't recall making. Recognizing these early can prevent further unauthorized transactions.

Why it matters: It's not just about the money. Knowing that someone might have unauthorized access can lead to stress and anxiety. Regular checks ensure peace of mind.

Staying Aligned with Your Financial Goals

Your checking account can reflect your financial discipline. You're in tune with your financial habits when you routinely monitor them. Unexpected expenses are part of life. By regularly knowing your balance, you can make informed decisions, such as whether to address an unexpected bill immediately or tap into savings.

Why it matters: Financial surprises can throw off your budgeting efforts. Regular checks keep you on track, always aligning with your financial goals.

Efficient Ways to Monitor Your Checking Account

Today, numerous tools and services simplify monitoring your checking account. Let's discuss some standard and effective methods people use for online and offline account checks.

Bank’s Website or App

Gone are the days of waiting for monthly paper statements. Now, most banks offer intuitive online platforms or mobile apps that let you view your account details instantly. This is a convenient option for those who are always on the move and prefer the best online checking account.

Why it matters: Instant access to our financial data helps us make prompt decisions. An efficient online service can make this process seamless.

Third-party Apps

Sometimes, we have multiple accounts across different banks. Third-party apps can be lifesavers in such scenarios. They let you connect all your accounts, giving you a holistic view of your finances. This is especially handy for those who want a comprehensive snapshot of their financial position, including high interest checking accounts.

Why it matters: Simplifying complex processes helps us stay organized. A consolidated view of our finances can lead to better money management.

ATMs

Besides cash withdrawal, ATMs have evolved to offer various services. One simple yet crucial service is providing account balances. It provides a fast account snapshot, especially when you're out.

Why it matters: ATM checks might be faster and more convenient when you're on the go.

Bank Visits

Something is reassuring about face-to-face interactions. Some people prefer to walk into their bank branch, interact with a teller, and get their account details. This method provides a personal touch in the age of increasing automation.

Why it matters: Personal interactions can lead to more in-depth conversations about financial health and, sometimes, personalized advice.

Phone Services

Only some people are tech-savvy, and only some prefer online platforms. Recognizing this, many banks offer phone services where customers can call to get their account balance and even recent transactions.

Why it matters: Having multiple channels to access our financial information ensures everyone stays informed irrespective of their tech comfort level.

Optimizing Your Checking Account Experience

The journey to financial prosperity often starts with a single step: choosing the correct checking account. While many of us emphasize the frequency of account checks, the bank and type of account we select play a substantial role.

Sign-up Bonuses

Bonuses can be an appealing reason to open an account. Many institutions lure new customers with attractive sign-up bonuses. But caution is critical here. Constantly scrutinize the terms and conditions before getting swayed by a significant bonus. Hidden clauses require you to maintain a minimum balance or set up direct deposits. The best online checking account might offer an enticing bonus, but ensure it doesn't come with high fees that negate its benefits.

Interest Rates

Interest-bearing checking accounts can boost your savings without any extra effort. The U.S. national average interest rate for these accounts might hover around 0.03%. Still, by actively searching, you might stumble upon high interest checking accounts that offer considerably more. Such accounts can incrementally increase your balance, especially if you maintain a substantial amount.

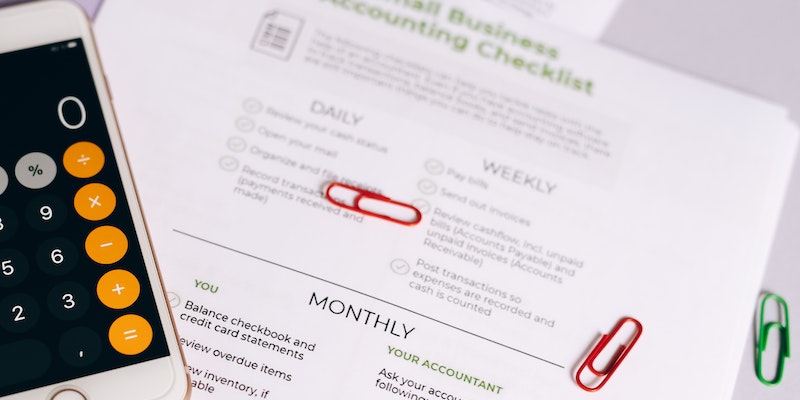

Fees

Unwanted fees nibbling away at savings can be a genuine concern for many. It's always a good idea to consistently review the charges linked to your account. By conducting a regular account check online, you're taking a proactive approach to stay informed about any deductions. Awareness of these fees, from monthly maintenance and transaction charges to ATM costs, can lead to substantial savings over time.

Many financial institutions highlight their best online checking account options with no monthly charges. If you're searching for high interest checking accounts, this perk can be incredibly enticing, ensuring you maximize returns while minimizing costs.

Having Multiple Checking Accounts

Financial experts often promote not putting all your eggs in one basket regarding investments. A similar philosophy can be applied to checking accounts. Multiple accounts can help you organize your finances and act as a safety net.

For daily expenses, one account might suffice. But what about saving for larger monthly bills like rent or mortgage? A separate account can be handy. It ensures that you don’t accidentally spend essential money.

Additionally, adopting this approach can streamline budgeting. You can assign different accounts for distinct purposes, such as one for groceries and another for entertainment. However, remember that the more accounts you have, the more frequently you'll want to check an account online to ensure everything aligns with your financial goals.

When to Contact Your Bank

Disc discrepancies can arise while we trust our banks to manage our money effectively. In such instances, being proactive and contacting your bank is crucial. They're there to help and resolve any issues you might face.

If you spot an unfamiliar transaction, you must report it immediately. With the rise in unauthorized activities, early reporting can limit liability and ensure swift resolution.