A Handy Self-Employment Tax Calculator to Help You Estimate Your Tax

Triston Martin

Jan 01, 2024

Ever found yourself tangled in the maze of self-employment taxes, wishing for a guiding light? A handy tax calculator tailored for the self-employed can surely solve your problem. Navigating tax obligations as a freelancer or entrepreneur can be highly difficult, often leaving you wondering how much of your hard-earned cash will go to Uncle Sam.

But worry not; this tool is here to simplify your tax estimation woes. With just a few inputs and clicks, you can get a clearer picture of what awaits in the tax realm, giving you peace of mind and a plan for your finances. So, let’s breakdown taxes, shall we?

What Does a Tax Calculator Do?

A tax calculator is like a digital tax buddy, simplifying the tax puzzle. It takes your income, expenses, deductions, and tax laws into account. Then, like magic, it creates the numbers to give you a clear view of what you owe or might get back from the taxman.

It's your pocket-sized wizard that navigates the tax for you, ensuring you're prepared for tax time. Especially for self-employed folks, a handy tax calculator is a lifesaver, reducing the complexities and leaving you with peace of mind. So, think of it as your tax sorcerer, casting away tax worries!

Perks of Using a Tax Calculator

Using a tax calculator is like having a wise friend who helps you navigate the tax without making it super complex. Here's why it's a smart move:

Simplicity at Your Fingertips

Tax calculators are designed for everyone, not just financial wizards. They break down complex tax calculations into simple, step-by-step processes. You input your numbers, and the calculator does the heavy lifting. No more tax-induced headaches!

Error Prevention

We're all human and sometimes make mistakes when doing manual calculations. Tax calculators reduce this risk. They use accurate algorithms, minimizing errors in your calculations. This ensures your tax filings are valid and reliable.

Real-Time Results

Waiting for tax professionals or doing it all by hand can take ages. Tax calculators provide instant results. As you input your financial data, it's calculating your taxes on the spot. Time-saving? Absolutely.

Tailored Insights

Different situations call for different tax approaches. Tax calculators are adaptable. They tailor the calculations based on your financial status, whether you're self-employed or working for a company. This means you get personalized insights rather than a one-size-fits-all approach.

Planning Power

Planning is crucial for managing your finances efficiently. Tax calculators can project your tax liabilities for the future based on the data you input. This can help you make informed decisions regarding investments, expenses, and savings.

Self-Employed Superpower

For self-employed individuals, tax calculators are a lifeline. They're often juggling multiple income streams and deductions. A tax calculator designed for self-employment ensures you're considering all the right factors specific to your situation, helping you optimize your tax situation.

Free and Accessible

Many tax calculators are available online for free. They are user-friendly and accessible at any time, giving you the flexibility to work on your taxes when it suits you.

With these numerous benefits, you can surely conclude why it is the best bet for you!

Best Handy Tax Calculator?

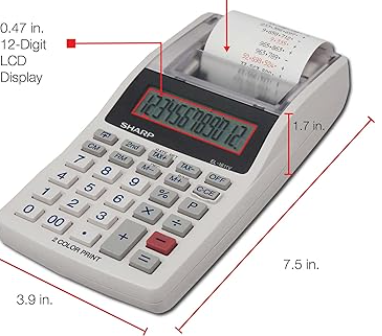

When it comes to handy tax calculators, the Sharp EL-1611V stands out as a top choice available on Amazon. This portable cordless calculator is a gem with features tailored for efficient tax calculations:

1. Clear and Precise Display

The calculator proudly features a spacious LCD screen that showcases 12 digits, guaranteeing effortless comprehension and validation of your computations. The screen is thoughtfully crafted with a dual-color scheme, incorporating black and red hues to enhance its legibility.

2. Automatic Tax Calculations

Utilizing a specialized tax calculation feature, you can efficiently and quickly compute taxes by entering the applicable tax rate. Additionally, you benefit from the convenience of securely storing and easily retrieving the tax rate for future use, ensuring a seamless tax calculation process.

3. Versatile Cost-Sell-Margin Function

When determining the selling price, cost, or profit margin, the cost-sell-margin function of this calculator truly shines. All you need to do is input any two variables, and this intuitive calculator will seamlessly handle the computation for you.

4. Error Correction and Review

The calculator has a check and correct function, allowing a comprehensive review and editing of up to 150 calculation steps. This ensures accuracy and gives you room to amend any errors.

5. Reliability and Portability

Not only is it powered by a battery backup, ensuring your data stays intact during power interruptions, but it's also designed for convenience. Compact and lightweight, you can easily carry and store it, making it a practical tool for on-the-go calculations.

At a reasonable price of $43 on Amazon, the Sharp EL-1611V has gathered high praise from global customers. It also has earned an impressive rating of 4.5 out of 5 stars from over 1,000 customer reviews. That’s why it is one of the top choices for a handy tax calculator, especially for individuals dealing with self-employment taxes!

Wrapping it Up!

A reliable tax calculator is your self-employment ally. It eases the burden of estimating taxes, ensures accuracy, and much more! So, go ahead and enjoy the convenience, simplify your financial life, and conquer those self-employment taxes with confidence! In a world where financial tasks can be daunting, having the right tool makes all the difference.