Understanding Modern Portfolio Theory

Susan Kelly

Jan 14, 2024

Are you looking to create a portfolio that maximizes return and minimizes risk? Modern Portfolio Theory (MPT) is one of the most popular methods investors use today. Based on Nobel Prize-winning research, MPT considers the different assets available in a portfolio and helps investors reduce their exposure to certain levels of risk while increasing returns.

We will provide an overview of MPT principles and strategies for implementing them with your investments. We will explore conversations with financial professionals on key concepts such as diversification, balancing expected return & risk, constructing portfolios with efficient frontier curves, and much more.

What Is the Modern Portfolio Theory?

The Modern Portfolio Theory (MPT) is a framework that uses mathematics and statistical analysis to evaluate the many investments available. Considering their return on investment, risk profile, correlations between different assets, and other factors can help investors create the most efficient portfolio.

MPT aims to maximize return while minimizing risk by diversifying one’s investments and using a given portfolio's most efficient risk/reward ratio.

How Modern Portfolio Theory Works

Modern Portfolio Theory uses a combination of mathematics and statistics to analyze investments. Its goal is to create the most efficient portfolio by considering return on investment, risk profile, correlations between different assets, and other factors.

MPT also looks at correlations between markets and backtesting them to identify patterns that can be used when investing. This technology allows investors to create a portfolio tailored to their risk tolerance and goals.

MPT also considers the impact of taxes on investments. By considering how different investment strategies will be affected by taxes, investors can make more effective portfolio decisions.

Challenges of Using Modern Portfolio Theory

Despite its advantages, there are also some drawbacks to Modern Portfolio Theory. While MPT benefits many investors, it’s important to understand the challenges associated with this approach before implementing it.

Time-Consuming

Creating a portfolio according to Modern Portfolio Theory can be time-consuming, depending on your investment goals and level of risk tolerance. Investors need to properly research their investments and the associated risks.

Difficulty in Implementing

MPT can be difficult to implement for inexperienced investors as it involves a lot of technical knowledge and calculations.

Limited Risk Tolerance

MPT assumes that all investors have the same risk tolerance, which may be inaccurate for some. This can lead to investors investing in assets they may need to be more comfortable with.

Overweighting Certain Assets

MPT can also lead to overweighting certain assets, which could result in a higher risk of loss. Overweighting is when an investor puts more money into a certain asset than others in the portfolio. This can be done by allocating too much of the total capital to one investment or not diversifying enough, leading to increased risk. Overweighting might offer short-term gains, but it ultimately increases risk and reduces potential returns for the overall portfolio.

Market Volatility & Unpredictability

As with any investment strategy, MPT is subject to market volatility and unpredictability. Investors must understand the risks associated with their investments and adjust their portfolios as needed depending on the current market situation.

Benefits of the MPT

Modern Portfolio Theory can be a valuable tool for investors looking to maximize their return on investment while minimizing risk. Here are seven benefits of MPT:

Diversification

MPT helps investors diversify their portfolios to reduce the overall risk. Investing in different asset classes ensures investors are independent of any particular asset. Investing in diverse instruments can also help protect investors from short-term market swings. By diversifying across different asset classes, investors can reduce their risk exposure and create a balanced portfolio with higher returns.

Balancing Expected Return & Risk

MPT helps investors balance their expected return and risk by considering the correlations between different assets and markets. This allows them to create portfolios with the most efficient risk/reward relationship for their goals. MPT also considers how taxes affect investments, helping investors make better financial decisions.

Furthermore, MPT considers the rate of return and volatility of different assets. By doing so, investors can calculate their risk tolerance levels and build portfolios with more efficient risk/reward ratios. This helps them achieve higher returns while minimizing their exposure to potential losses.

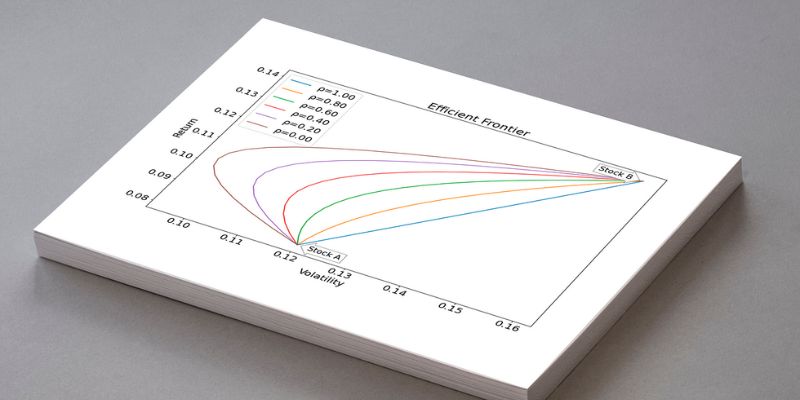

Constructing Portfolios With Efficient Frontier Curves

MPT uses efficient frontier curves to identify the optimal combination of assets for a given portfolio. By plotting different portfolios against expected return and risk, investors can visualize the most efficient portfolio for their circumstances.

Access to Professional Financial Advice

When using MPT, investors have access to professional financial advice that can help them make more informed decisions when creating their portfolios. Financial professionals have expertise in analyzing investments and have access to the latest tools available to create efficient portfolios.

MPT advisors also provide investors with valuable insights into specific asset classes and a broader view of the market. They can help investors understand how different investments may perform under various market conditions and build a portfolio that reflects their goals.

Easy to Monitor Progress

MPT allows investors to easily monitor their progress, using backtesting and other analysis tools to measure performance. This helps them identify areas where they may need adjustments for future success.

Investing in diverse asset classes also gives investors a more comprehensive view of their investments, enabling them to track performance in real-time and adjust accordingly. Furthermore, MPT enables portfolio rebalancing regularly to ensure that the risk/reward ratio is optimized for their individual needs.

Easier Risk Management

MPT helps investors manage risk more effectively by understanding how different investments correlate and the associated risks. This can help investors make better decisions when constructing their portfolios.

More Opportunity for Higher Returns

By utilizing MPT strategies, investors may have more opportunities to achieve higher returns than traditional methods. They can access data to find the most efficient portfolio for their needs.

Modern Portfolio Theory is a valuable tool for investors looking to maximize their returns while minimizing risk. By understanding MPT principles and strategies, investors can construct a portfolio that fits their specific goals and risk tolerance. Additionally, by utilizing professional financial advice and properly monitoring progress, investors can ensure that their portfolios remain optimized for future success.

FAQS

How does MPT measure risk?

MPT measures risk by looking at different assets' expected returns and volatility. It also considers how taxes affect investments, helping investors make better financial decisions. By plotting different portfolios against expected return and risk, investors can visualize the most efficient portfolio for their circumstances.

Which field of MPT is best?

The best field of MPT will depend on the investor's individual goals and risk tolerance. However, diversifying across different asset classes can help reduce overall risk. Additionally, balancing expected return and risk is important when constructing a portfolio and considering taxes. Professional financial advice should also be considered when making investment decisions.

Which country is best for MPT study?

Many countries are best for MPT study. Investors should research the markets in their own countries to form an understanding of how different asset classes and markets correlate with one another. Additionally, investors should consider consulting professional financial advisors knowledgeable about the local market and can provide valuable insights into specific investments and strategies. This way, investors can make the best decisions for their investments.

Conclusion

Overall, Modern Portfolio Theory is a complex but necessary concept that all investors must understand, and the best way to approach it is by assessing past performance, thoroughly researching potential investments, and diversifying your portfolio. Understanding MPT can help you better balance risk with reward for future portfolios to achieve superior returns over time. Tools are available to help simplify the process of understanding modern portfolio theory and applying it in practice. It is important to stay current on the changing industry trends to make well-informed decisions and maximize gains.