Are Home Equity Loans Tax Deductible?

Susan Kelly

Feb 23, 2024

Deciding to take out a loan, whether it's for home or business use, involves many important factors. In most cases, tax implications should also be taken into consideration.

When looking at home equity loans specifically, one of the most common questions is if these types of loans are tax-deductible. The answer can be more complex, so let's explore this issue further and examine the key factors determining if your home equity loan would qualify as a potentially deductible expense on your taxes.

An Overview of Home Equity Loans and Tax Deductions

Home equity loans, or second mortgages, are a popular way to finance home improvements or debt consolidation. But before applying for one of these loans, it's important to understand their tax implications. Are home equity loans tax deductible? In most cases, the answer is yes; however, certain conditions must be met to qualify for a deduction.

When Are Home Equity Loans Tax Deductible

There are various things to think about when determining whether a home equity loan is tax deductible.

Generally speaking, if a home equity loan was taken out to pay for renovations or the acquisition of an investment property, the interest paid on the loan may be tax deductible. However, you won't be able to deduct those costs from your taxes if you use the money from a home equity loan to pay off credit card debt or other personal expenses.

It is also important to note that the maximum amount of interest that can be deducted depends on your annual income and filing status. For example, married couples with an adjusted gross income (AGI) of up to $100,000 can deduct all their interest expenses on up to $100,000 of home equity loan debt. However, those with an AGI above this amount can only deduct interest on a maximum of $50,000 in home equity loans.

Ultimately, speaking with a tax professional for specific advice regarding your situation and the potential deductions related to a home equity loan is best. That way, you can be sure you are claiming all allowable deductions while still abiding by the relevant laws and regulations.

What Are the Requirements for a Home Equity Loan to be Tax Deductible

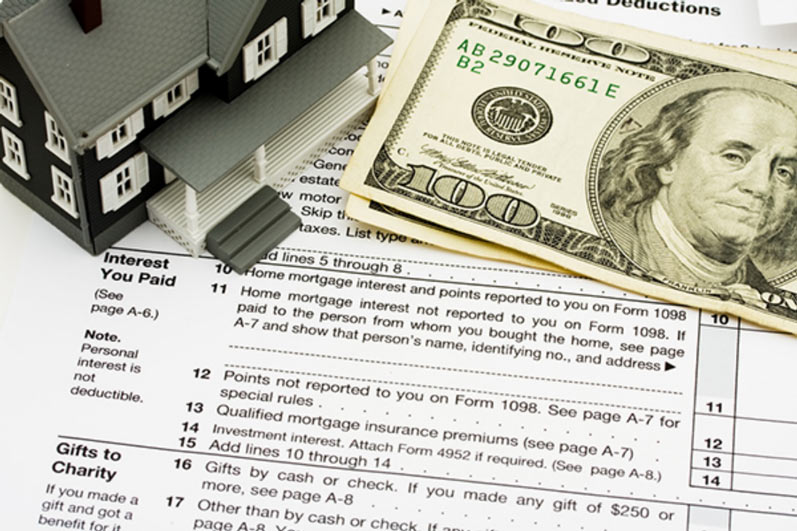

The IRS allows individuals to deduct the interest paid on home equity loans if certain requirements are met.

For a home equity loan to qualify for tax-deductible status, it must be used to solely pay for improvements on a primary residence or second home. This requirement means that the funds from a home equity loan cannot be used to purchase non-essential items such as vacations, cars, or other entertainment expenses.

Additionally, the total amount of debt taken out against your property should be at most $750,000 to qualify for deductions.

Taxpayers must itemize their deductions on Form 1040 Schedule A to be eligible to deduct the loan interest paid. The mortgage interest deduction is limited to the interest paid on up to $100,000 in home equity debt for filing single or married filing separately. For all other filers, the limit is up to $50,000 of home equity debt.

It's important to remember that if you use any portion of a home equity loan for anything other than improving your residence or purchasing a second home, such as paying off credit cards or student loans, then the interest will not be tax-deductible.

Additionally, if you have taken out more than $750,000 in mortgages and home loans against your property, the interest paid on any sum above this amount will not be deductible.

It's important to speak with a trusted tax professional or financial advisor to accurately assess your situation and determine whether your home equity loan qualifies for a deduction.

What Other Types of Deductions Does a Home Equity Loan Qualify For

A home equity loan may qualify as a deduction for other purposes than just income taxes. Depending on the nature of your loan and its purpose, certain deductions can be applied to help reduce your overall financial burden.

For example, if you use a home equity loan to pay off medical bills or credit card debt, those payments might be deductible from your federal taxes. You may also be able to deduct points (or prepaid interest) paid when obtaining a home equity loan if it meets specific criteria set forth by the IRS.

Additionally, certain costs related to taking out a home equity loan may qualify as tax-deductible expenses, including title fees, recording fees, appraisal fees, and legal document preparation charges.

Considerations To Make Before Taking Out a Home Equity Loan

When considering taking out a home equity loan, it's important to remember that several factors could impact your ability to deduct interest paid on the loan from your taxes. Here are some considerations to make before taking out a home equity loan:

- Verify what type of loan you're getting and how it will be used. Home equity loans can be used for various reasons, such as buying cars or paying off debt. However, not all uses qualify for tax deductions, so it's best to check with an accountant or tax professional before signing any documents.

- Determine if you meet the criteria set by the IRS for deducting interest on a home equity loan or line of credit. The loan must be "secured by your main or second home and used to buy, build, or improve that home to qualify," as outlined in IRS Publication 936.

- Ensure that the total amount of debt incurred is below the IRS threshold for maximum deductible interest. The current deduction limit for home equity loans is $100,000 combined (including mortgages), so stay within this amount when taking out a loan for any other purpose.

- Understand how different types of loans are taxed differently. Home equity lines of credit are not eligible for tax deductions unless used specifically for remodeling purposes, while regular home equity loans may qualify if the proceeds go toward home improvements.

- Consider other tax implications that may arise with taking out a loan against your home's equity, such as early withdrawal penalties or the potential for incurring capital gains taxes if you sell the property within five years of taking out the loan.

Tips for Maximizing Your Tax Benefit from a Home Equity Loan

- Check with the IRS and your state's laws on what constitutes a qualified home equity loan for purposes of the deduction.

- Know the differences between a home equity loan and other types of loans, such as cash-out refinancing.

- Be aware of the rules regarding how much interest is deductible

- Consider ways to use multiple loans to further reduce your taxable income

- Speak with an accountant or financial advisor if you have questions about which types of loans would best suit your situation.

FAQs

Is money from a home equity loan taxable?

The answer depends on the purpose of the loan and how you use the funds. Generally, interest paid on a home equity loan as part of a refinance or purchase is tax-deductible if the loan does not exceed certain limits. However, if your home equity loan is used for other purposes, such as debt consolidation or home

Is home equity loans interest taxes deductible in 2023?

Yes, in most cases, the interest paid on a home equity loan is tax-deductible.

What types of home loans are tax deductible?

Generally, home loans for purchasing or refinancing a primary residence and loans used to improve the property are tax deductible.

Conclusion

Understanding home equity loans and tax deductions is easier than you think. Home equity loans interest is taxes deductible if the loan meets certain requirements. If not, there may be other types of deductions that could qualify for a deduction. To maximize your tax benefit, consult your accountant or financial advisor before deciding. The answer is yes – home equity loans can be tax deductible sometimes – but it is not always automatic and requires careful consideration before committing to such a loan.