How to Deposit Checks on Your iPhone

Triston Martin

Dec 11, 2023

Are you tired of making trips to the bank just to deposit a check? With your iPhone, you can now do it all from the comfort of your home. Mobile deposit is a convenient feature offered by many banks, allowing you to deposit checks using your smartphone. In this guide, we'll walk you through the step-by-step process of depositing checks with an iPhone.

Setting Up Mobile Deposit

To deposit checks with your iPhone, you'll first need to set up a mobile deposit with your bank. Here's a step-by-step guide to get you started:

Download the App: First, download your bank's mobile banking app on your iPhone. Look for the official app provided by your bank to ensure security and reliability.

Log In or Sign Up: If you're already using mobile banking, simply log in using your existing credentials. However, if you're new to mobile banking, you'll need to sign up. Follow the app prompts to create your account.

Enable Mobile Deposit: After you log in, go to the settings or options menu in the app. Search for the settings to activate mobile deposits and follow any extra instructions given by your bank. This step is crucial to activate the mobile deposit feature.

Verify Your Account: Your bank may require you to verify your account before using mobile deposit. This usually involves confirming your identity or linking a checking account to your mobile banking profile. Follow the verification process outlined by your bank to ensure smooth and secure transactions.

Depositing a Check

Depositing a check with your iPhone is a simple process once you've set up a mobile deposit with your bank. Here's a breakdown of the steps involved:

Open the App: Begin by launching your bank's mobile banking app on your iPhone. This is usually available for download from the App Store.

Select Mobile Deposit: Within the app, look for the option to deposit a check. This might be labeled as a "Mobile deposit" or something similar. Tap on this option to proceed.

Take a Photo: Place the front of the check on a flat surface with adequate lighting. Position your iPhone camera over the check and take a clear photo of the front side. Make sure all details on the check are visible and legible.

Capture the Back: After photographing the front side, flip the check over and capture an image of the back. Ensure that you've endorsed the check with your signature and any other required information, as specified by your bank.

Enter Check Details: In the app, enter the amount of the check and select the account where you want the funds deposited. Double-check the amount to avoid any errors.

Review and Submit: Before finalizing the deposit, carefully review all the information you've entered. Make sure the check images are clear, the amount is correct, and you've selected the right account for deposit. Once you're satisfied, submit the deposit.

By following these straightforward steps, you can deposit a check quickly and conveniently using your iPhone. Mobile deposit eliminates the need for trips to the bank and allows you to manage your finances with ease, right from your smartphone.

Tips for Successful Mobile Deposits

While mobile deposit is convenient, there are a few tips to keep in mind to ensure successful deposits:

Good Lighting

Find a well-lit spot to snap photos of your checks. Clear, well-lit images reduce errors during deposit. Adequate lighting ensures that all details on the check are captured accurately, minimizing the risk of the bank rejecting the deposit due to unclear or incomplete images.

Check Endorsement

Before depositing via mobile, always endorse the back of your check with your signature. This simple step helps authenticate the check for processing. Endorsing the check ensures that the rightful recipient legally endorses it and reduces the likelihood of any issues arising during the deposit process.

Verify Deposit Limits

Be aware of any limits your bank sets on mobile deposits—whether daily or monthly. Knowing these limits helps you avoid exceeding them and facing potential issues. Some banks may have different limits based on factors such as account type or customer status, so it's important to review your bank's policies to ensure compliance.

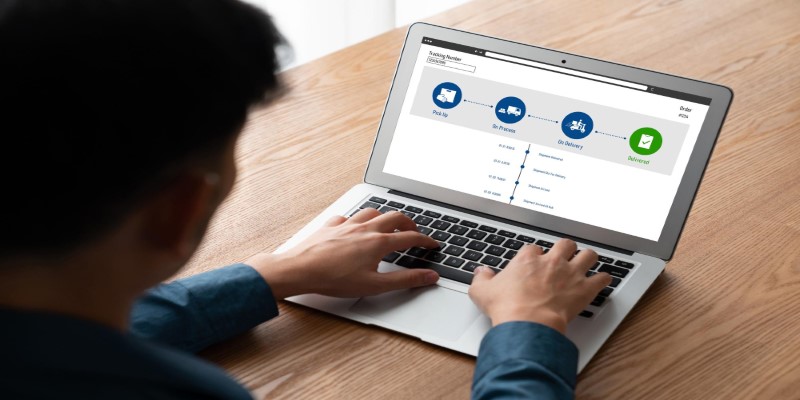

Monitor Your Account

After depositing a check, keep tabs on your account. Check for the correct deposit amount and ensure it is reflected in your account balance. If you notice any discrepancies or encounter problems, promptly reach out to your bank for assistance. Monitoring your account regularly allows you to quickly identify and address any issues that may arise, ensuring that your deposits are processed accurately and in a timely manner.

Troubleshooting Common Issues

Even with the convenience of mobile deposit, you may encounter occasional issues. Here are some common problems and how to troubleshoot them:

Blurry Images: If the photos of your check are blurry or unclear, try adjusting the lighting or angle to improve the quality of the images.

Rejected Deposits: Sometimes, your bank may reject a deposit for various reasons, such as an unreadable endorsement or exceeding deposit limits. If your deposit is rejected, double-check the information you entered and try again. If the problem persists, contact your bank for assistance.

Delayed Funds: While many deposits are processed quickly, some may take longer to clear, especially for larger amounts. If you're expecting funds from a deposited check and they haven't appeared in your account, be patient and check with your bank for any processing delays.

Account Verification: If you're having trouble verifying your account for mobile deposit, ensure that you've provided all necessary information and followed any verification steps outlined by your bank. If you're still unable to verify your account, contact your bank's customer support for assistance.

Conclusion

With the convenience of mobile deposit, you can say goodbye to long lines at the bank and hello to easy check deposits from your iPhone. By following the simple steps outlined in this guide, you can quickly and securely deposit checks anytime, anywhere. So why wait? Start using mobile deposit today and simplify your banking experience with your iPhone.