What Is Form 1045: Discussed With All Details

Susan Kelly

Feb 24, 2024

Introduction

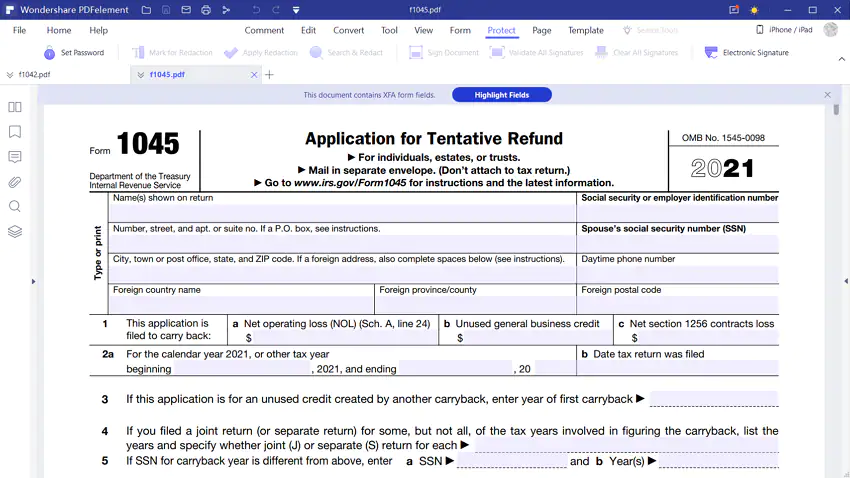

Form 843 of the Internal Revenue Service is used by individuals, estates, and trusts to submit a request for a prompt tax refund. In the instructions for Form 1045, there is a list of four different reasons for requesting a refund: Carryback of operating losses from the prior year (NOL). Carryover credit for new business purchases. Carryback of a net 1256 contracts' worth of losses A tax refund that was overpaid by subsection 1341(b) (1). Form 1045 guidelines define losses.

What Is Form 1045? Form 1045 may be submitted as an alternative to Forms 1040-X and 1041 by private individuals, estates, and trusts. If you want your tax refund more quickly, use Form 1045 rather than Forms 1040X or 1041. The Internal Revenue Service (IRS) must receive and process Form 1045 within ninety days, and the form must be submitted within one year of the NOL. Individuals can submit forms 1040X and 1041 up to three years after the NOL event that triggered them. Form 1040X and Form 1041 will not be processed by the IRS within the allotted 90 days, and the agency has six months to do so.

What Does IRS Form 1045 Mean for Individuals?

Because of the intricacy of the IRS Form 1045, you might find it helpful to consult with a tax professional to decide the most appropriate strategy for your specific set of circumstances. It is possible that you would become liable for the alternative minimum tax for a prior tax year if you filed Form 1045, for example. This would be the case if you filed the form. That may still be worthwhile for some people, but it is essential to understand any and all potential tax ramifications before proceeding.

If you are considering submitting IRS Form 1045, you should be aware that recent changes to the tax law have impacted the requirements of NOLs. NOLs could no longer be carried back for the two tax years before the passage of the Tax Cuts and Jobs Act of 2017, which took effect in 2017. NOL requirements for Form 1045 have been updated due to recent revisions to tax law. Because of the Tax Cuts and Jobs Act of 2017, net operating losses (NOLs) cannot be carried back to the two tax years before 2017.

How to File Form 1045: Application for Tentative?

Taxpayers must submit Form 1045 no later than one year after the end of the tax year. The state's first section requires the individual to fill it out to provide personal information such as their name, address, and Social Security number. The following section will have questions for you to answer regarding the nature of the carryback. The person filing taxes is responsible for calculating the amount of the reduction in tax resulting from the carryback for each year before the NOL or unused credit. At the very bottom of the form, the taxpayer and, if applicable, the tax preparer will sign and date the document.

Form 1045 Is Filed To Carry Back The Following

This is the form you will use if you have a net operating loss or unused credits and want to carry them back to the year three years prior to the current one. When you enter the date when the most recent tax return for the current year was submitted, this form will become active. When you enter this date, Worksheet 1 and, if necessary, Worksheet 2 will become operational to determine whether or not you have a carryover from the first or second year before the current year.

Waiving The Carryback Period

An individual can choose to carry an NOL forward solely, as opposed to first moving it back. A non-taxable income loss (NOL), an unused credit, a net section 1256 contract loss, or a claim of proper adjustment must be reported on Form 1045 within one year of the end of the year in which the adjustment or loss occurred.

Form 1045X or Other Amended Return

In most cases, a person has until three years following the original return's due date to file an amended return for the relevant tax year.

Line 1b

If you request a provisional refund based on the carryback of unused general business credit, put the amount of the credit in question here.

Conclusion

Form 1045 of the IRS is used to apply for an expedited tax refund, typically associated with a company loss that can be carried back to earlier tax years. To receive a refund more quickly, taxpayers can consider utilizing IRS Form 1045 rather than updating their prior tax returns.